Navigating the Evolving T-Bond Futures Market: A Comprehensive Analysis

Unveiling the Consolidation Phase in the T-Bond Futures Market

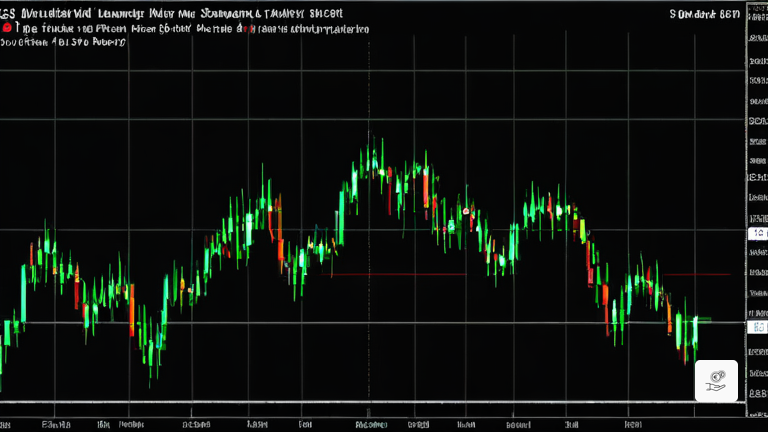

The T-Bond Futures market, a vibrant arena for financial traders, is currently undergoing a period of consolidation, as evident on the daily chart. This consolidation phase is characterized by price action hovering around the 50 and 100 moving averages, indicating a potential shift in market sentiment.

Bond Buying Wanes as Risk-On Assets Take the Spotlight

In recent months, bond buying has been a dominant force in the T-Bond Futures market. However, as risk-on assets gain traction, the allure of bonds appears to be diminishing. This shift in sentiment is reflected in the upward price trajectory of ZB, suggesting a potential change in trend.

Key Levels to Watch

Traders should keep a watchful eye on the following key levels:

– **Immediate Support at 107’03:** This price level has historically served as a strong support zone, attracting buying interest. A sustained price above this level could signal continued bullish momentum.

– **Resistance Near 50 MA:** The 50-day MA represents a crucial resistance level. A decisive close above this moving average could trigger further buying, potentially shifting the intermediate trend to bullish.

Conclusion: A Glimmer of Bullish Momentum

The current T-Bond Futures landscape paints a picture of emerging bullish momentum, with the market challenging the 50-day MA resistance. Traders should closely monitor the interaction with this MA, as a breakout could confirm a trend reversal. As always, it is imperative to exercise prudent risk management and adapt positions based on evolving market conditions.