Navigating the Proprietary Trading Landscape: A Comprehensive Comparison

Unveiling the Depths of Proprietary Trading Firms

In the ever-evolving world of trading, finding the right proprietary trading firm is akin to discovering a hidden treasure chest amidst turbulent waters. To aid traders in this exhilarating quest, we’ve meticulously crafted a comprehensive comparison guide that transcends the ordinary.

Essential Parameters for Evaluation

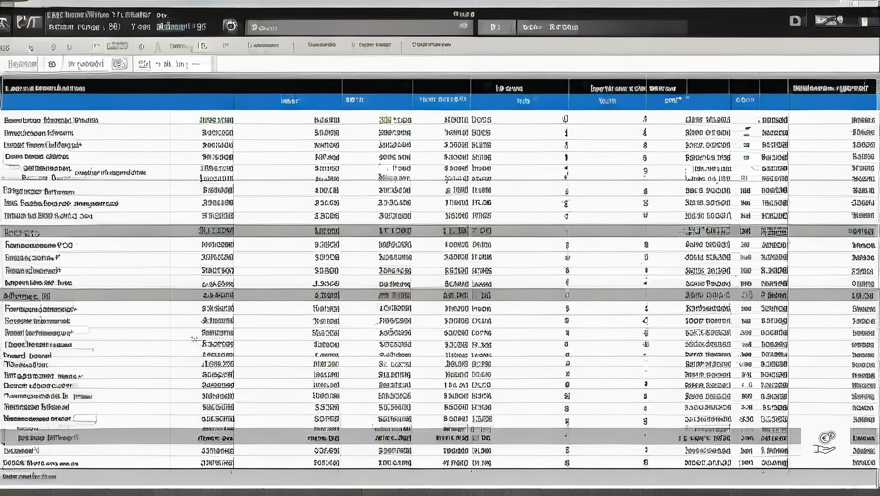

Delving into the heart of our comparison lies a myriad of critical parameters, each serving as a compass to navigate the tumultuous seas of proprietary trading. These key metrics include:

– Targeted Profit Margins

– Daily Drawdown Limits

– Maximum Drawdown Thresholds

– Trading Day Requirements

– Profit Sharing Schemes

Comparative Analysis

Embark on a journey through the depths of our comparison, where each proprietary trading firm is a unique island, offering its own treasures and challenges.

Here’s a glimpse into how these firms fare against each other in the vast ocean of trading:

The Islands of Proprietary Trading

Discover the allure of each island and the riches they promise:

Conclusion: Charting Your Course

Uprofit Top 5 Things: Revealing the Depths of Self-Employed Trading Ventures

- Specific profit margins

- Daily withdrawal limits

- Maximum reduction thresholds

- Trading day requirements

- Profit sharing schemes

As you navigate the turbulent waters of proprietary trading, armed with our comparison guide, remember that the choice of island is as unique as the trader themselves. May your journey be filled with profitable ventures and discoveries.