Insider Trading: A Complex World of Legal and Illegal Practices

Understanding Insider Trading

Insider trading, a term often associated with illicit activities, can surprisingly involve both legal and illegal practices. In essence, it refers to the trading of a public company’s stocks while possessing non-public information about that company.

Legal Insider Trading

In the United States, insider trading is deemed legal if certain conditions are met. Individuals with substantial ownership or influence in a company, such as officers, directors, and those holding 10% or more of the company’s shares, may engage in insider trading if they disclose their trades publicly with the Securities Exchange Commission (SEC) using Form 4.

Illegal Insider Trading

Illegal insider trading, on the other hand, occurs when individuals trade on material, non-public information that is not available to the general public. This type of trading is prohibited by law because it creates an unfair advantage for those with access to privileged information.

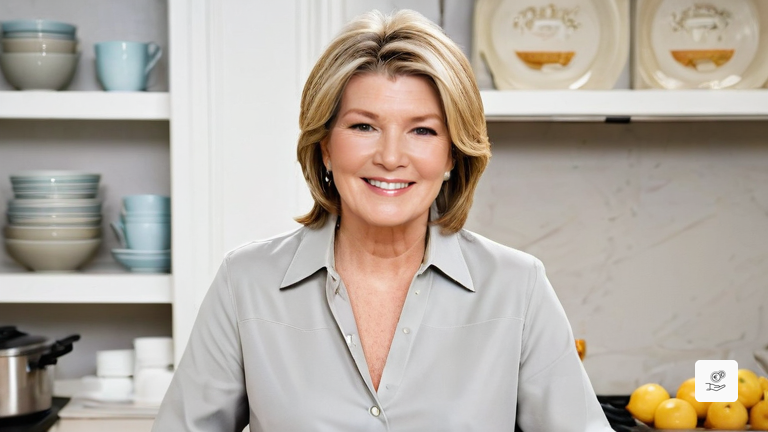

Martha Stewart’s case serves as a cautionary tale of the consequences of illegal insider trading. In 2004, she was convicted of selling shares of ImClone Systems two days before the company’s stock plummeted in value due to negative news about its experimental cancer drug.

Martha Stewart’s Involvement

Stewart’s defense argued that she sold her shares based on a tip from her broker, who also handled trades for ImClone’s CEO. However, the SEC suspected foul play and launched an investigation.

Despite the dismissal of the insider trading charges, Stewart was found guilty of conspiracy and obstruction of justice, resulting in a five-month prison sentence. She also faced steep fines and interest payments from the SEC and was forced to step down as CEO of her company, Martha Stewart Living Omnimedia.

The SEC’s Stance on Insider Trading

The SEC and other regulatory bodies take a strict stance against insider trading, emphasizing the importance of fair and transparent markets. They actively pursue and prosecute individuals who engage in illegal insider trading practices, sending a clear message that such activities will not be tolerated.