The Ultimate Showdown: Funding Pips vs. E8 Funding (Normal) – A Trader’s Guide to Success

Navigating the Prop Trading Maze: A Comprehensive Comparison

In the ever-evolving world of prop trading, discerning traders seek out partnerships that empower their strategies and align with their aspirations. This in-depth analysis delves into the intricate details of two prominent players in the industry: Funding Pips and E8 Funding (Normal). By unraveling their unique offerings and key similarities, we aim to equip traders with the knowledge they need to make informed decisions and unlock their full potential.

Trading Objectives: A Tale of Two Firms

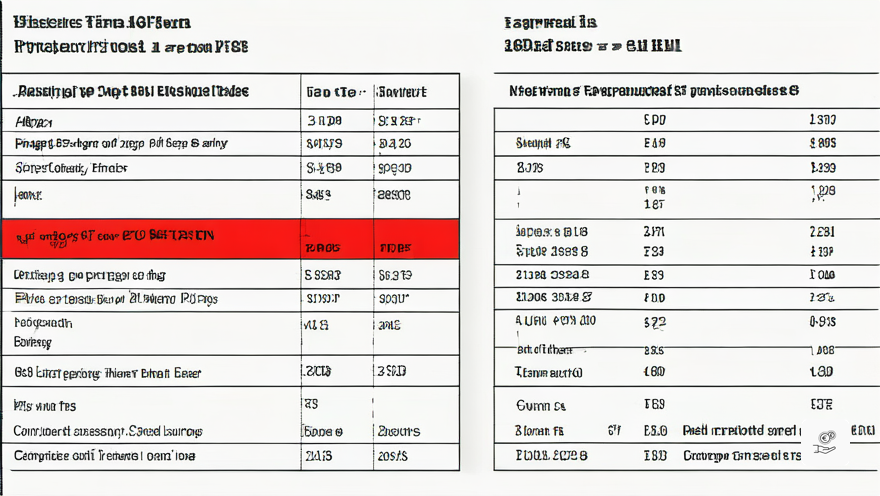

At the heart of every prop trading firm lies its trading objectives, which serve as the roadmap for traders’ success. Both Funding Pips and E8 Funding (Normal) share common ground in their Phase 1 and Phase 2 profit targets, setting the bar at 8% and 5% respectively. However, subtle nuances emerge in their approach to maximum daily loss and maximum loss limits.

Funding Pips grants traders flexibility with its scalable maximum daily loss of up to 7% and maximum loss of up to 14%. E8 Funding, on the other hand, maintains a fixed 5% maximum daily loss and a scalable maximum loss starting at 8%. While neither firm imposes minimum trading day requirements, both offer unlimited trading periods for both phases.

When it comes to profit split, Funding Pips offers a generous range from 80% to 90%, while E8 Funding maintains a consistent 80%. These variations cater to traders with diverse risk appetites and profit-sharing preferences.

Unveiling the Unique Charms of Funding Pips

Funding Pips distinguishes itself with its trader-centric approach, allowing for unrestricted trading styles that empower traders to execute their strategies with confidence. Unlike many firms that restrict trading during news events, Funding Pips embraces the volatility, giving traders the freedom to capitalize on market movements. Additionally, traders are permitted to hold positions overnight and over weekends, maximizing their potential for profit.

However, it’s worth noting that Funding Pips strictly prohibits hedging, a risk management technique employed by some traders. This rule ensures that traders remain focused on their primary trading strategy and avoid excessive risk-taking.

Conclusion: Empowering Traders’ Success

Navigating the labyrinth of accessories trading: a complete comparison, including uprofit name

- Flexible daily maximum loss and maximum loss limits

- Trader-centric approach allowing for unrestricted trading styles

- Take advantage of market volatility for profit opportunities

- Hedging ban to maintain focus on primary strategies

- Variety in the distribution of benefits to meet various risk appetites

This comprehensive analysis of Funding Pips and E8 Funding (Normal) provides traders with a clear understanding of the intricacies that set these firms apart. By carefully considering the trading objectives, unique features, and profit-sharing models, traders can make informed decisions that align with their individual trading styles and goals. Ultimately, the choice between these two reputable firms hinges on the specific needs and preferences of each trader, empowering them to navigate the competitive landscape of forex funded programs and unlock their full potential.