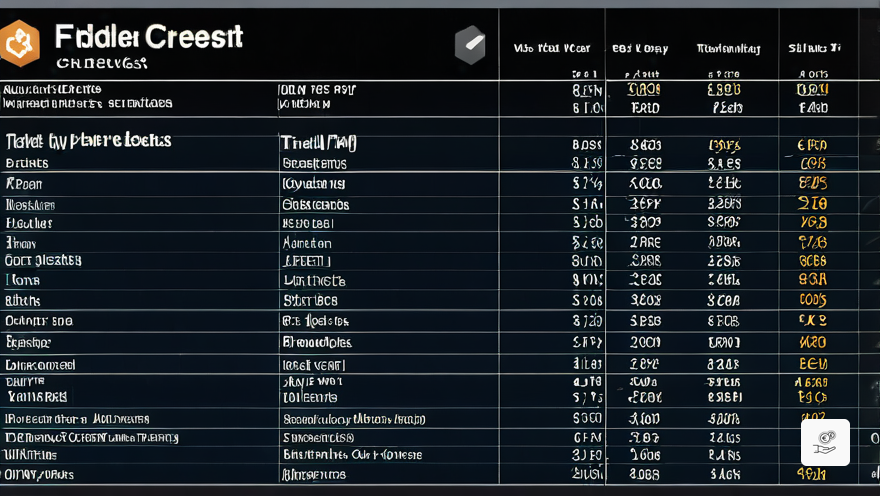

Unveiling the Trading Landscape: A Comprehensive Guide to Fidelcrest and FundedNext

Navigating the Trading Objectives

Every trader embarks on a unique journey, and choosing the right trading environment is paramount. Fidelcrest and FundedNext, two prominent prop firms, offer distinct trading objectives tailored to cater to diverse trading styles. Understanding these objectives is the key to unlocking your trading potential.

Phase 1: Setting the Foundation

In Phase 1, Fidelcrest’s Normal Risk model requires a 10% profit target, while the Aggressive Risk model sets the bar at 15% or 20%. FundedNext’s Stellar program, on the other hand, aims for a slightly lower 8% profit target.

Phase 2: Scaling Up

As traders progress to Phase 2, the profit targets remain similar for Fidelcrest’s Normal Risk model, with options for 5% or 10%. The Aggressive Risk model maintains its 15% or 20% target. FundedNext’s Stellar program keeps the profit target at 5%.

Risk Management: Striking a Balance

Managing risk is crucial for any trader. Fidelcrest’s Normal Risk model sets a maximum daily loss of 5%, while the Aggressive Risk model allows for a higher 10%. FundedNext’s Stellar program also maintains a 5% maximum daily loss.

When it comes to maximum loss, Fidelcrest’s Normal Risk model limits it to 10%, while the Aggressive Risk model allows for a higher 20%. FundedNext’s Stellar program, similar to its daily loss limit, sets the maximum loss at 10%.

Trading Duration: Flexibility and Discipline

Fidelcrest offers flexibility in trading days, with no minimum requirement. FundedNext’s Stellar program, however, requires traders to log a minimum of 5 calendar days of trading.

Regarding the maximum trading period, Fidelcrest’s Normal and Aggressive Risk models provide a 60-day window for both Phase 1 and Phase 2. However, traders can extend this period indefinitely with an add-on option. FundedNext’s Stellar program, on the other hand, offers unlimited trading periods for both Phase 1 and Phase 2.

Profit Sharing: Aligning Interests

Profit sharing is a key aspect of any prop firm relationship. Fidelcrest’s Normal Risk model offers an 80% profit split, while the Aggressive Risk model provides a generous 90% split. FundedNext’s Stellar program offers a flexible profit split ranging from 80% to 90%, aligning with the trader’s performance.

This comprehensive comparison of Fidelcrest and FundedNext’s trading objectives provides traders with a valuable roadmap to navigate the prop trading landscape. By carefully considering these factors, traders can make an informed decision that aligns with their trading strategies and risk tolerance.