Victor Sperandeo’s Career in the Financial World

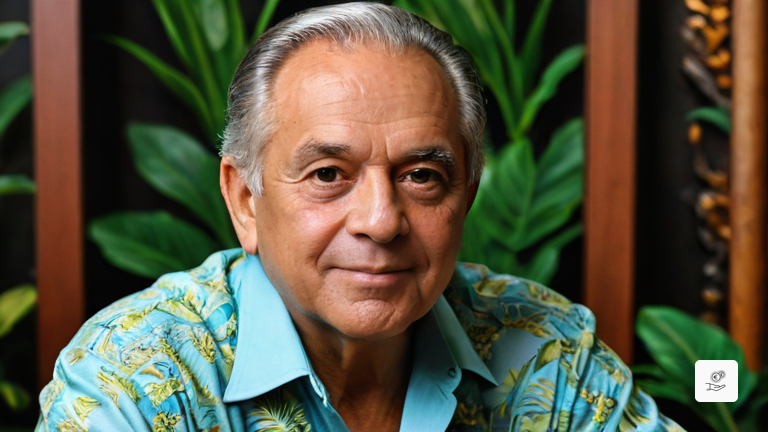

Victor Sperandeo: A Visionary of the Financial Market

With over 45 years of success in the financial world, Victor Sperandeo is recognized for his acumen as a trader and financial commentator. Nicknamed ‘Trader Vic,’ he has worked not only for his own benefit but also managing investments for prominent figures such as George Soros and Leon Cooperman.

Specializing in commodities trading, Victor Sperandeo gained international prominence by predicting the 1987 stock market crash. Now based in Grapevine, Texas, he leads Alpha Financial Technologies, LLC, stressing the importance of objectivity and consistency in investment decisions.

The Life and Career of Victor Sperandeo

Born in Queens, New York, Victor Sperandeo showed from a young age his passion for risk and obtaining profits. Initially attracted to poker, he soon understood that success in this game was based on managing probabilities.

Deciding not to pursue a professional career in poker, Victor ventured into the New York work world at the age of 20, finding his true calling in trading. Today, in addition to his achievements as a trader, he is a popular speaker and successful author.

The Rise of Victor Sperandeo in the Trading World

Starting his career on Wall Street, Víctor Sperandeo went through several stages before consolidating himself as a trader. After initial experiences, he found his place in the over-the-counter options market, achieving notable successes that led him to found his own company, Ragnar Options.

He then joined Interstate Securities, where he managed private accounts with great learning. After founding Rand Management Corporation, Victor strung together years of gains until he became a prominent figure in the financial world.

Victor Sperandeo’s Trading Strategies

Víctor Sperandeo advocates for clear trading rules to maintain objectivity and avoid emotional decisions. He stresses the importance of trading with a defined plan, following market trends, using stop-losses, exiting when in doubt, and avoiding overtrading.

His conservative and disciplined approach has been key to his success as a trader. Studying his methods and philosophies can provide other traders with valuable insights to achieve consistent and responsible gains in the financial markets.